How Are We Different?

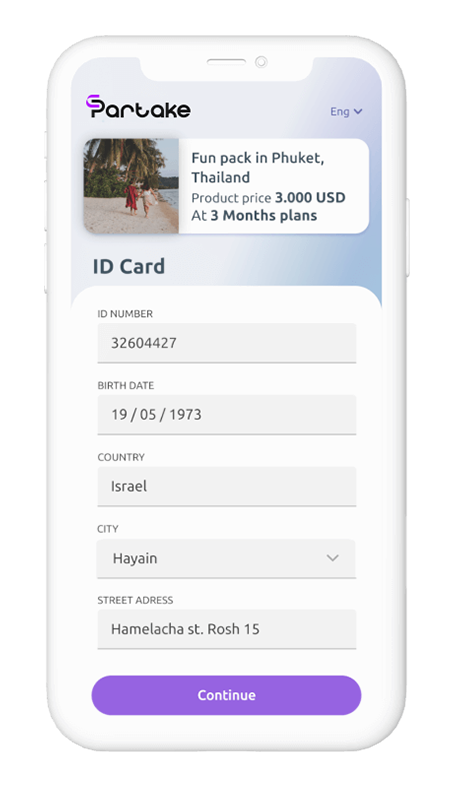

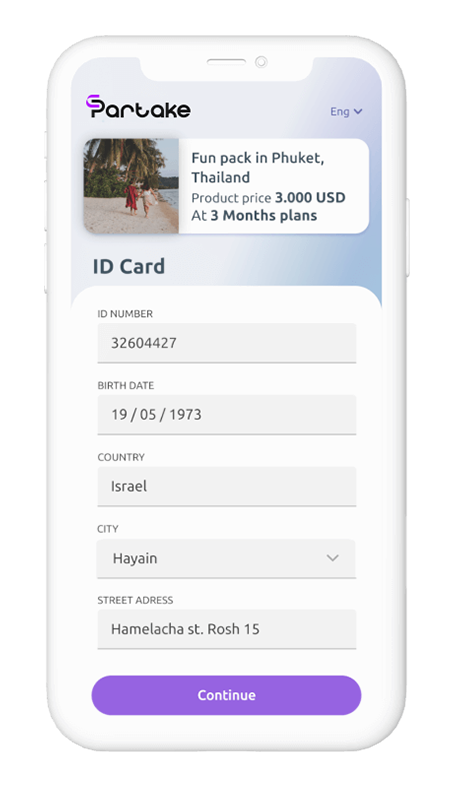

Online and POS solution

Easily add Installment Manager to your website or send a payment link at a point of sale from your management panel to offer a customizable, white-labaled experience.

The Next-Gen BNPL that increases conversions and generates new revenue streams. Create tailor-made payments and keep data-in house.

Offer your shoppers attractive payment plans, a smooth user experience, and support multiple purchases to sell more.

Own customer data and cash flow, determine financial terms and choose a level of risk.

Use customer insights to make better decisions in order to drive repeat sales.

Partake Installment Manager stands out as it provides not only tailored-made solutions based on your business needs but a true partnership to help you succeed in the long term. Serving as a lender, you can set your own flexible financial terms based on your business needs and choose a level of risk. Unlike other BNPL solutions, Partake Installment Manager supports multiple purchases, so you can sell more. Moreover, you own your customer data and use it for upsales without need to pass your customer to 3rd party lenders.

Yes, we offer consumer financing that works can work both online and at point of sale. If you decide to offer Installment Manager out of your online store, you can simply generate payment links and share them via text messages or email.

Definitely! Partake offers you a white-labelled solution. Once again, integration is seamless and fast, helping you reach and onboard new customers with ease.

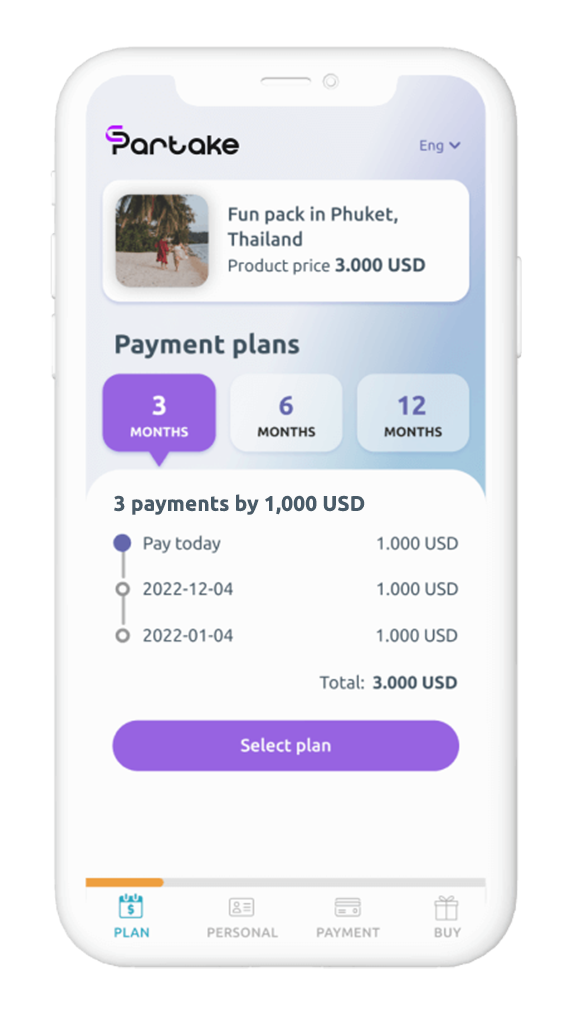

Buy now pay later services, also known as BNPL, are an innovative new way for businesses to offer their customers the ability to purchase items and then spread out digital payments over time. A buy now pay later platform enables customers to buy goods and services using installment payment plans rather than paying for everything upfront.

With BNPL services, customers can apply for a line of credit with the provider and then use that credit to purchase items from participating merchants. Depending on thze provider, customers must make a down payment before being approved for a BNPL service. After approval, they can shop for items at participating merchants and pay for them using BNPL.

Once customers make a purchase, they will receive an invoice from the provider outlining all the details such as the total cost and payment due dates. Customers will then make regular payments to settle their accounts.

No, BNPL services are different from credit. Credit is typically used to pay for large purchases or when customers don’t have enough money to pay upfront. With a BNPL system, customers can purchase items using the service and pay for them in installments.

The BNPL process is quick and simple, making it ideal for businesses looking to increase sales without worrying about lengthy credit checks or high-interest rates. BNPL technologies have become increasingly popular, offering customers the flexibility to buy now and pay later without additional debt.

1. Increased customer loyalty. BNPL services make it easier for customers to purchase items and services, which increases customer loyalty and retention.

2. Risk management. BNPL services can help to mitigate the risk associated with delinquent payments.

3. More payment options. BNPL services offer customers more payment options, increasing customers’ likelihood of purchasing.

4. Capturing new customers. BNPL services can create an opportunity to capture new customers who may not have been willing to make a large up-front payment.

5. Increased revenue. BNPL services can increase revenue by encouraging customers to purchase more items.

Overall, BNPL is an excellent way for businesses to offer customers more flexibility options when purchasing goods and services.

Any business that wants to offer customers more payment options can benefit from incorporating a BNPL service. This includes retailers, online merchants, e-commerce stores, subscription services, and more. Additionally, businesses can customize their BNPL software to meet the unique needs of their customers.

Many businesses who use external BPNL services lose control of how their payment solutions are managed. Whether it be through the origination process, the ownership of consumer data, or the number of installments made, these factors are generally predetermined through the existing BPNL’s policies.

Partake, however, enables merchants, retailers and other enterprises to set their own terms, origination processes, installment requirements, collections and more, thus giving businesses an entirely new kind of BPNL service, known as an Installment Manager.

The Installment Manager is the next generation buy now pay later service. Developed with the goal of empowering businesses, Partakes Installment Manager (the next generation BPNL) is a robust and feature rich technology that allows businesses to oversee and gain insight into a number of elements that were previously made unavailable to them.

Partake Installment Manager stands out as it provides not only tailored-made solutions based on your business needs but a true partnership to help you succeed in the long term. Serving as a lender, you can set your own flexible financial terms based on your business needs and choose a level of risk. Unlike other BNPL solutions, Partake Installment Manager supports multiple purchases, so you can sell more. Moreover, you own your customer data and use it for upsales without need to pass your customer to 3rd party lenders.