Telcos can easily create new revenue streams to increase ARPU, by branching out into financial services. Leveraging a massive user database together with unique marketing and behavioral insights you can get a competitive advantage in the financial market.

However, launching your own lending product could be a big challenge, as you need both vetted technology and versatile expertise. Partake is here to help you to branch into the lending market.

Partake goes beyond traditional SaaS collaboration by offering you True Partnership. Our experts provide valuable insights and work closely with our customers on their financial models and integration to ensure a smooth and optimal launch of their own lending service.

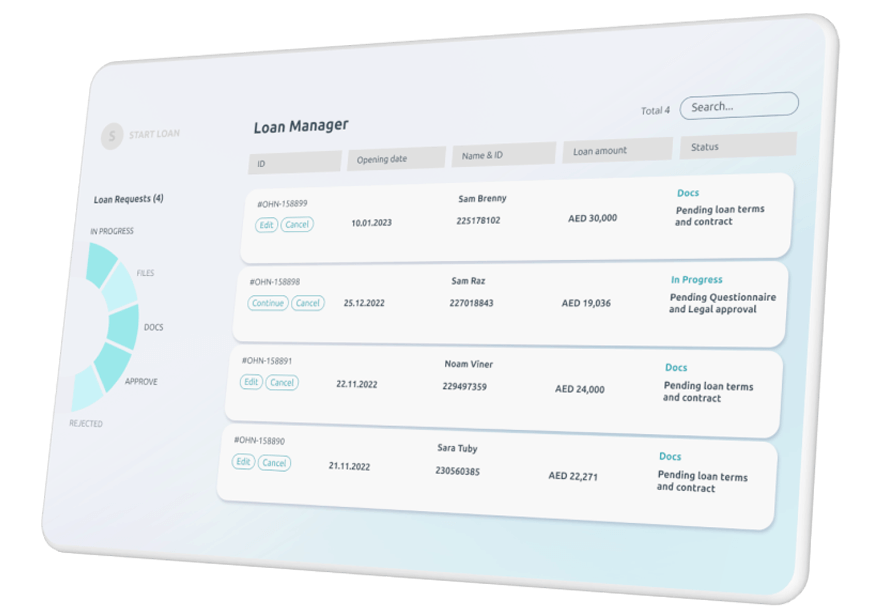

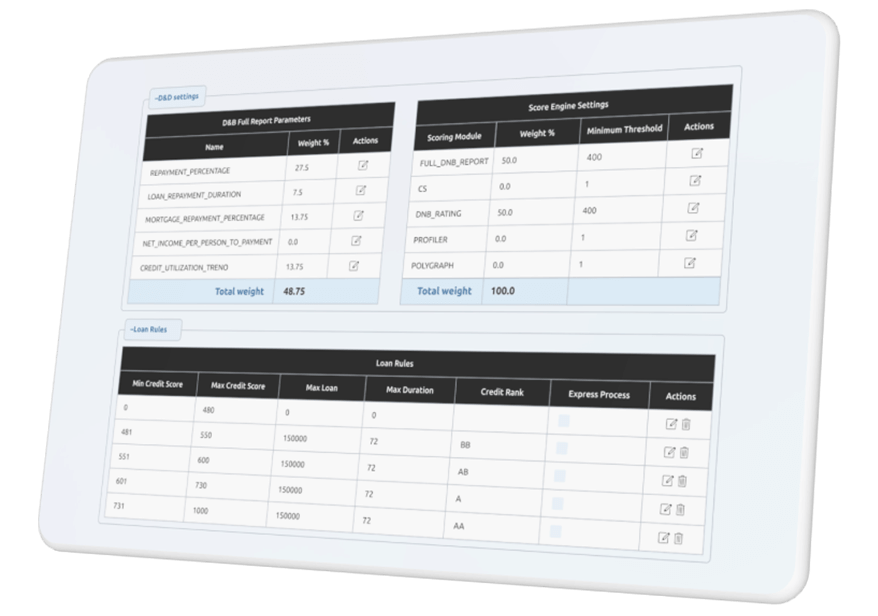

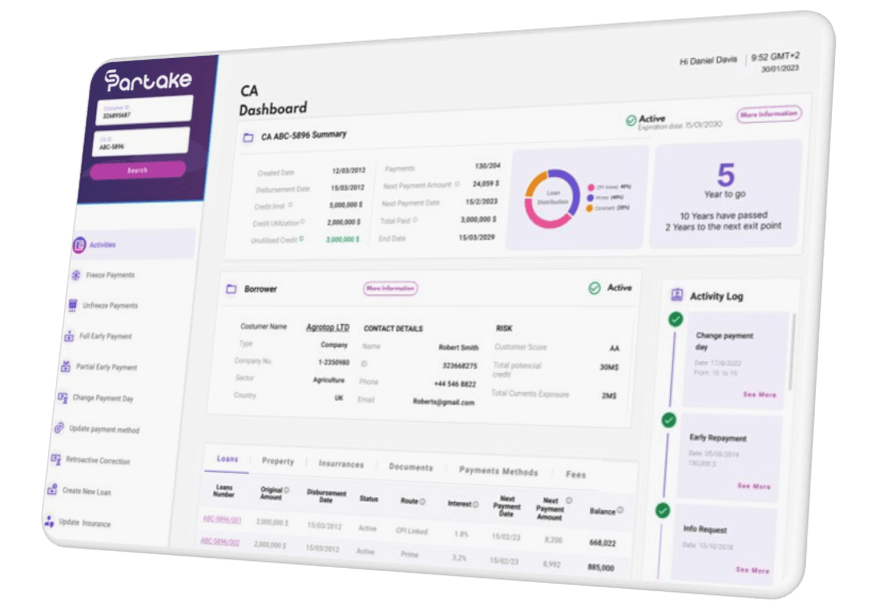

Partake provides an all-in-one lending platform including Loan Origination, Risk Assessment, and Loan Lifecycle Management for both Unsecured and Asset-Based Loans. You get a One-Stop-Shop solution enabling you to manage loans at any stage, create new lending products and score your customers by leveraging your unique customer insights.

Our lending platform is a field-tested solution deployed at multiple customer locations to power a diverse set of lending services. Retain all the flexibility to self-manage your lending products, while knowing that you can fully rely on a robust, scalable, and vetted solution.